Data to change your world

Audience segments, insights & advisory based on the purchase behaviour & characteristics of 16m Australians.

Our ServicesData to change your world

We source a diverse range of data sets to help you gain insights to understand your customers better.

How we can help you

Data Commercialisation

We transparently commercialise industry data sets and link them together within an ISO-certified smrtr Data Universe to empower our offerings and benefit Data Partners.

Audience Segments

Over 500 Audience Segments packaged into six targeting types predict which consumers and businesses are more likely to demonstrate a particular behaviour.

Data Enrichment

Data Universe attributes are matched with first-party data to enrich the view of the people in that data set and shape a meaningful story.

Market Insights

Market and category performance benchmarking and profiling provide next best actions regarding market share, customer understanding and market potential.

Custom Insights

Leverages the Data Universe and our analytic capability in a bespoke manner to solve a specific business need or provide customisable solutions for common industry pain points.

Who we do it for

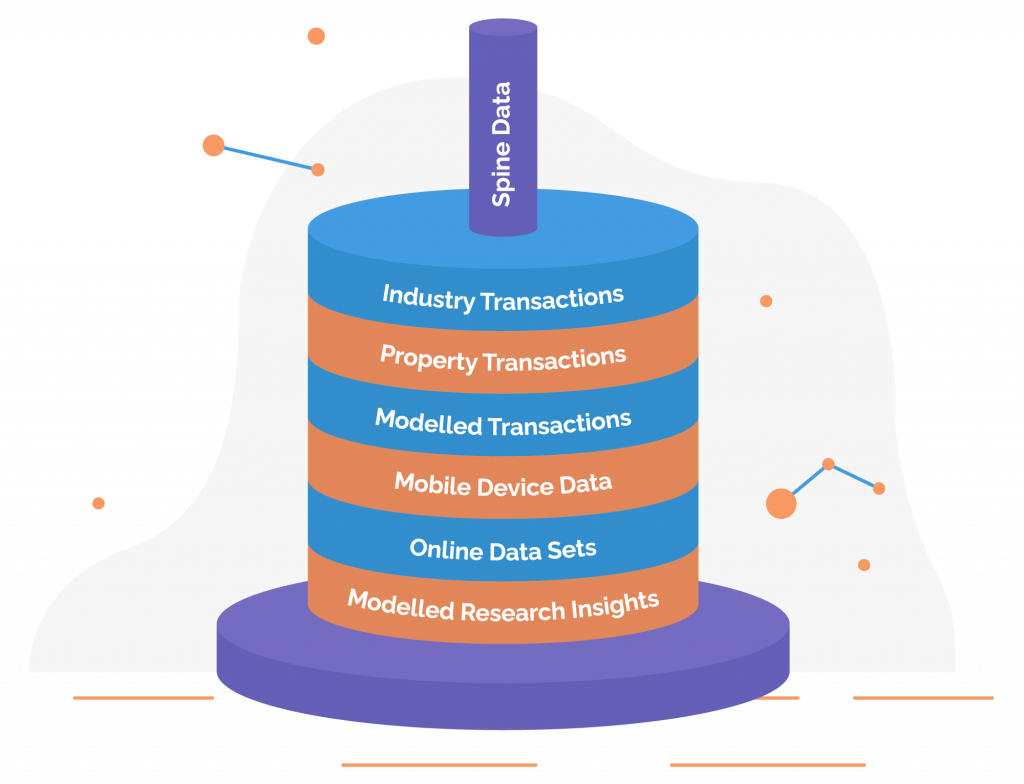

smrtr Data Universe

Data is usually created and made available in silos meaning most companies have one view of the world. The true picture only emerges from connecting several different views and by sourcing a wide variety of data sets across multiple industries. And by applying world-class analytics, we provide much better solutions to your business needs.

Future-proofed for a cookie-less world, the smrtr data universe is a collection of unique data assets containing demographic, socio-economic, attitudinal, transactional and location data on over 16 million individuals. It’s aggregated, analytically packaged and onboarded to your preferred environment or interface.

Privacy compliant data

We have three key factors to consider when managing and using personal information:

- Privacy and Compliance: We rely on a wide variety of partners to power our data universe. Our contracts ensure all data providers must meet applicable privacy requirements when sourcing, using, and sharing data.

- Opt-out: Consumers can easily opt-out of their data being used by us and our clients.

- Security: We use the highest level of encryption to transfer data and our cloud backend security is at the highest industry standards. Our information security processes are certified as compliant to ISO27001 standards.

Our Data Partners

An ever-growing data partner network delivering transaction-based data sets across a wide range of industries is what makes the smrtr data universe so predictive and unique.

We are always looking to secure new partnerships that unlock new possibilities for our clients, while always adhering to consumer privacy.

Easy Setup

Get started in 30 seconds

The full monty burke posh excuse my French Richard cheeky bobby

spiffing crikey Why gormless, pear shaped.!

Share research with the whole team

My good sir car boot super old owt to do with me say no biggie cheeky bugger

Track changes in feedback over time

My good sir car boot super old owt to do with me say no biggie cheeky bugger

Advanced mining Traffic

My good sir car boot super old owt to do with me say no biggie cheeky bugger

14-day free trial.

No credit card required.

The full monty burke posh excuse my French Richard cheeky bobby

spiffing crikey Why gormless, pear shaped.!

Starter

Per month

- All Lite features

- Unlimited contacts

- Remove Sendinblue

- logo from emails

- Advanced statistics

Starter

Most popular

Per month

- All Lite features

- Unlimited contacts

- Remove Sendinblue

- logo from emails

- Advanced statistics

Starter

Per month

- All Lite features

- Unlimited contacts

- Remove Sendinblue

- logo from emails

- Advanced statistics

Trusted by

great brands

lurgy David, mufty Oxford blatant A bit of how’s

your father.

What you get

with SaasLand

spiffing crikey Why gormless, pear shaped.!

- Client accounts

- Visitor & Keyword-level trackin

- Unlimited user accounts

- Email summaries

- Email call alerts

- Dynamic Saas Thames

- Google Analytice Integration

- Google AdWords Integration

- Automated text replies

- Advanced reporting

- Local numbers

- International pone numbers

- Call recording

- Instant number setup

- Toll-free numbers

- Port your numbers in

- Whisper messages

- Custom call-tagging

- Greeting messages

- Simultaneous ring

© 2019 SaasLand, LLC. All rights reserved. Proudly made in NY

Got Questions?

We have all the answers! Well, maybe not all but we’ll do our best to help.